Zoho is no longer content with just building SaaS. The Chennai-based unicorn is now making a bold play for the mainstream fintech arena with its upcoming payments app. So, can the famously bootstrapped B2B titan conquer the consumer fintech world?

Cracking The UPI Wars: Zoho is deepening its push into fintech with the upcoming launch of Zoho Pay, a consumer payments app designed to take on giants like Google Pay and PhonePe. The app, which will allow users to send and receive money, is currently in internal testing and will be available both as a standalone product and integrated within Zoho’s messaging app, Arattai.

The Arattai Pitch: Fueling this consumer push is the revival of Arattai, Zoho’s messaging app, which has clocked 48 Mn downloads on the Play Store in 2025 so far. The unicorn’s consumer fintech strategy hinges on Arattai integration – leveraging the app’s captive user base and offering payments without leaving the chat interface. With this, Zoho aims to turn the chat platform into an all-in-one super app, mirroring the playbook of its global rivals.

Beyond Consumer Payments: Zoho’s fintech ambitions extend far beyond online payments. The company recently unveiled point-of-sale devices, a QR soundbox, and other payout capabilities. The roadmap also includes lending, broking, insurance, and investments – a full-stack fintech play, not just UPI.

The Execution Challenge: While Zoho’s strength lies in its bootstrapped, profitable software model, consumer payments demand different muscles – network effects, deep pockets, alternate revenue streams and consumer support at scale. With PhonePe and Google Pay handling billions of monthly transactions with established merchant networks and consumer habits, Zoho has its work already cut out.

With its resources being stretched from consumer apps to semiconductor chips to LLMs, can Zoho’s famously patient culture survive its multi-front war for mass-market dominance? Let’s find out…

From The Editor’s Desk- The IT ministry has proposed amendments to the IT Rules, 2021 to mandate all online platforms to label all AI-generated content. It has also suggested stricter obligations for social media platforms with regards to synthetic content.

- The move comes in response to the explosion of AI-generated content on social media. While many use cases are harmless, like photo filters, there’s growing concern over the misuse of deepfakes for spreading misinformation and committing financial fraud.

- The issue has gained prominence with several high-profile incidents. Recently, actors Akshay Kumar, Abhishek Bachchan, and Aishwarya Rai took the legal route to protect their personality rights from being exploited by deepfakes.

Uniphore’s $260 Mn Mega Round

Uniphore’s $260 Mn Mega Round - Conversational automation startup Uniphore has raised $260 Mn in its Series F round from NVIDIA and others at a flat valuation of $2.5 Bn, the same as its unicorn round in 2022, to shore up its AI tech stack.

- Founded in 2008, the SaaS platform initially focused on call centre automation. It has since evolved into a comprehensive AI company, offering a platform that combines conversational AI and workflow automation to streamline customer experiences.

- By securing strategic investments from the biggest names in chips and data, the round places Uniphore at the center of the fierce competition to become the go-to AI platform for large enterprises.

- The foodtech giant has received a fresh GST demand notice of INR 128.4 Cr from Uttar Pradesh tax authorities. The order cites alleged short payment of output tax and excess availment of input tax credit during FY24.

- This notice adds to Eternal’s growing list of GST demands from various states, including two notices totalling INR 1,200 Cr from Maharashtra tax authorities, INR 40 Cr from Karnataka, and INR 17.7 Cr from West Bengal tax officials.

- This comes as Eternal’s business model has been bracing multiple headwinds – bloating expenses, Blinkit’s pivot to inventory-led model and a stagnant core food delivery business.

- The fintech minicorn’s net profit zoomed multifold to INR 18.8 Cr in FY25 from just INR 40 Lakh in the previous fiscal year on the back of a 127% YoY jump in operating revenues to INR 656 Cr in FY25 and a tight leash on its spending

- Founded in 2014, Easebuzz offers a comprehensive suite of payment solutions for businesses including PoS machines and software. The platform claims to serve over 2.5 Lakh clients, processes 3 Mn transactions daily and boasts an annual GTV of $50 Bn.

- Easebuzz has built a sustainable business by bundling software services with payments. This SaaS-plus-payments model has created a defensible moat and a recurring revenue stream, with SaaS now contributing 35% of its revenue.

- The early-stage VC firm has announced the final close of its fifth fund at $129 Mn (INR 1,132 Cr), double the size of its $64 Mn Fund IV. The new fund will back pre-seed and seed stage startups, and will dish out cheques in the range of INR 1 Cr to INR 15 Cr.

- Founded in 2012, India Quotient has made over 100 sector-agnostic investments in the last decade, backing names such as SUGAR Cosmetics, Kuku FM and others.

- This comes as early stage startup funding hit a snag in H1 2025, declining 31% YoY to $406 Mn. However, as per Inc42’s recent investor survey, early stage bets are expected to capture 58% of investments next year.

Zepto’s ESOP Bonanza

Zepto’s ESOP Bonanza - The quick commerce unicorn has expanded its ESOP pool by $170 Mn, taking the total value of its stock option pool to over $500 Mn. Alongside this, Zepto has approved an $84 Mn interest-free loan for its employee welfare trust.

- The move is aimed at boosting employee retention and incentivising its employees ahead of its IPO. Notably, this is one of the largest ESOP pools among late-stage Indian startups in the consumer internet segment.

- This comes as the quick commerce major is planning to file its IPO papers with the SEBI by early 2026 to raise at least $800 Mn via the public offering. The startup was able to scale its order value by 200% in the past 18 months.

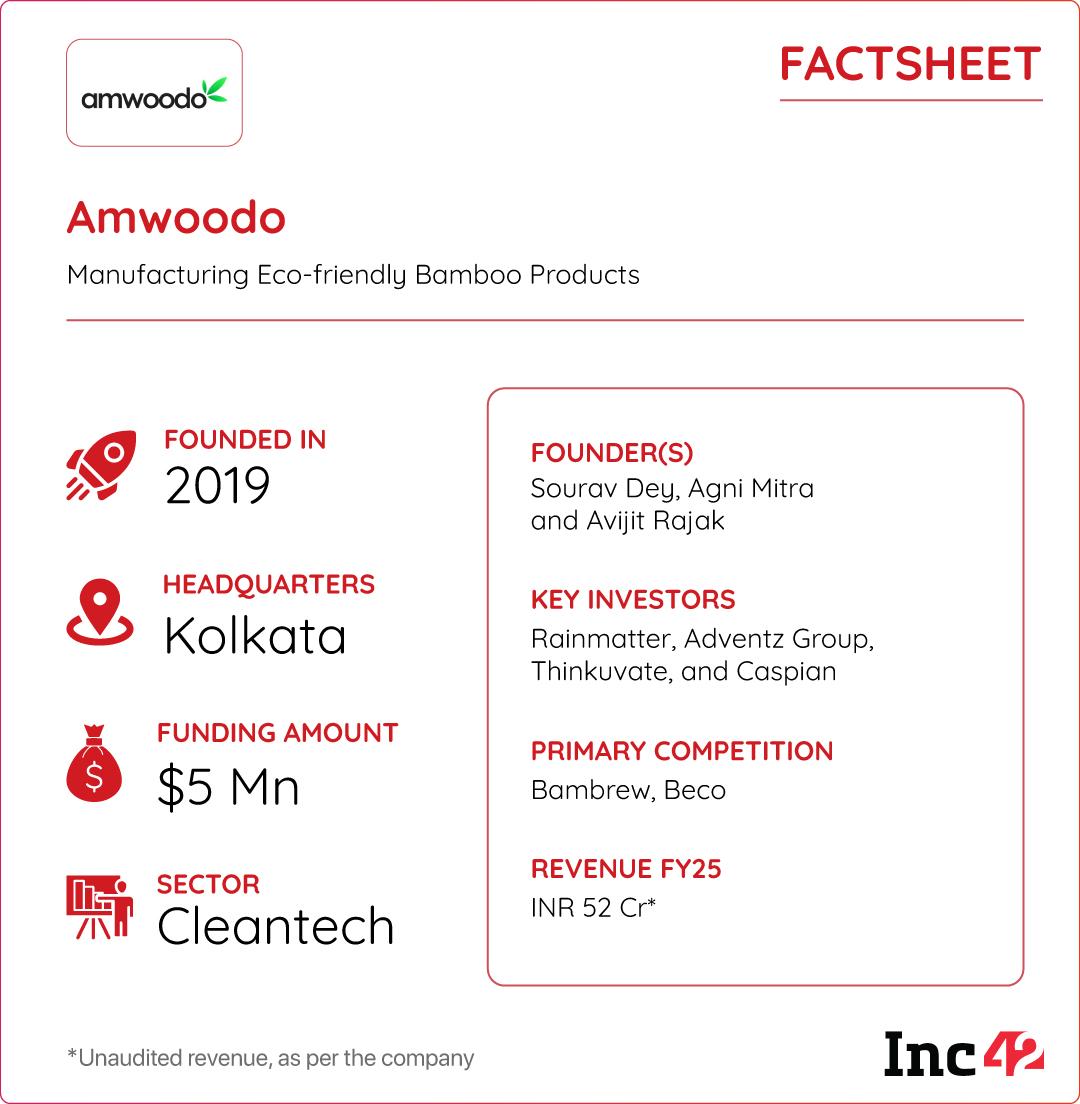

India generates nearly 9.3 Mn tonnes of plastic waste annually, making it the world’s largest plastic polluter. To solve this brewing environmental crisis, Amwoodo is pioneering a shift to eco-friendly living by creating everyday products from bamboo.

From Hotels to Homes: Founded in 2019, Amwoodo began as a B2B supplier, providing bamboo toothbrushes and razors to hotel chains like Taj and ITC. Later, the startup expanded into the D2C space and launched consumer brands like ImeCo and ShaveCo, which sell lifestyle essentials like tissues, bottles, cutlery, shaving products and oral care offerings.

Amwoodo sells its products on its own marketplace Ecoconscious as well as on ecommerce and quick commerce platforms like Amazon, Blinkit and Zepto.

The Sustainability Push: The startup claims to be on track to clock INR 100 Cr in revenues for FY26. Alongside, it also claims to be EBITDA and PAT positive, with its core focus firmly on fostering sustainable ecosystems. With a presence in six international markets and a strong foothold in India, can Amwoodo capitalise on the growing global demand for eco-friendly products?

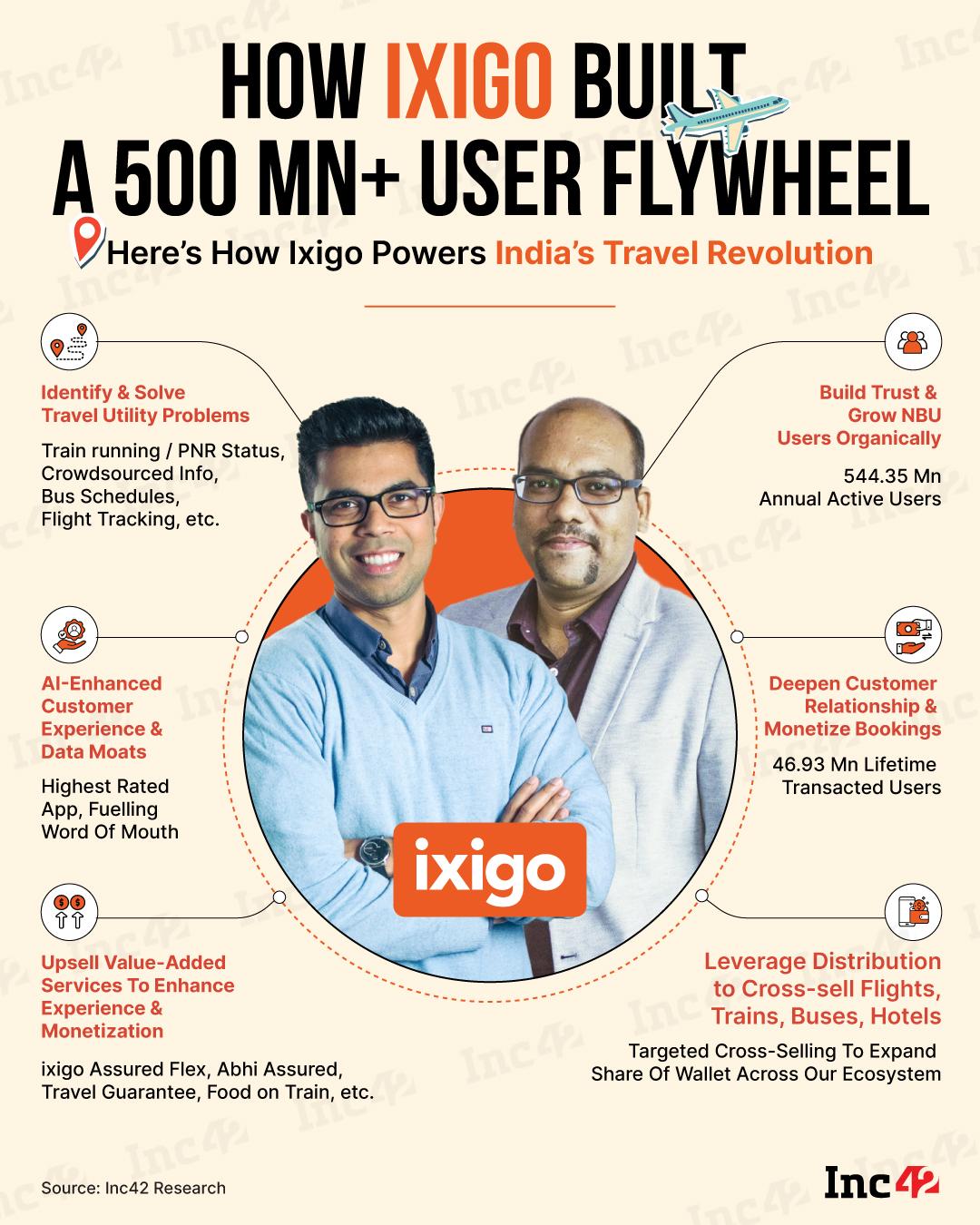

Travel tech giant ixigo’s ‘Built for Bharat’ model has made it a go-to platform for India’s travellers, blending affordability with innovation through AI-driven personalisation, cross-selling and value-added services.

The post The Expanding Zoho-verse, Regulating AI & More appeared first on Inc42 Media.

You may also like

Netflix announces dark new Robert Downey Jr drama based on award-winning show

Guns N' Roses issue official statement on Axl Rose's onstage meltdown

Want a VIP number plate in the UAE? Here's how to get yours at Dubai's 81st traffic auction

Costa Coffee making major menu change in UK stores from Friday

Significant Growth of Himalayan Glacial Lakes Amid Climate Change