Despite posting a flat net loss of INR 544.6 Cr in Q4 FY25, Paytm has made a healthy stride towards its goal of turning profitable in Q1 FY26. What’s interesting about this equation is that while profitability may look far-fetched for Paytm, it is not.

Understanding The ‘Loss’ Equation: If it were not for the INR 522 Cr exceptional loss during the quarter, Paytm would have posted a loss before tax of INR 19.9 Cr, a giant leap from the INR 550.5 Cr loss incurred in the year-ago quarter.

During the quarter, the fintech giant was slapped with an INR 492.4 Cr non-cash accelerated charge (the very cause of the massive loss) due to Paytm founder and CEO Vijay Shekhar Sharma surrendering 2.1 Cr ESOPs.

Here are the key takeaways of the quarter:

- Operating revenue declined 19% YoY to INR 1,911.5 Cr during the quarter

- On a QoQ basis, the company’s loss grew 118% from INR 208.5 Cr in Q3

- Average monthly transacting users increased to 7.2 Cr in Q4 versus 7 Cr in Q3

- Merchant subscriber base for Paytm’s payment devices expanded by 8 Lakh to 1.24 Cr

Falling Revenue: For the full FY25, the operating revenue of the company declined 31% YoY to INR 6,900.4 Cr. One of the biggest factors was the RBI’s clampdown on Paytm Payments Bank, and then the Paytm Insider sell-off weighed heavily on the fintech major’s revenues. The ticketing business harvested INR 297 Cr in FY24 revenues.

Paytm’s Profitability Parade? As the fintech startup races to achieve profitability, it has and offloaded verticals that do not align with its strategy of sustainable revenue growth.

For Paytm, the bigger challenge now is not just achieving profitability but sustaining revenue growth and convincing the market that its turnaround story holds firm. For now, here is how .

From The Editor’s Desk: The foodtech major has transferred the ownership of The Bowl Company, Homely, Soul Rasa, and Istah to Kouzina, which will now manage all operations of the cloud kitchens. This comes as these brands have been grappling with operational challenges.

: The EV manufacturing major listed on the BSE at INR 326.05, a 1.57% premium against the IPO issue price of INR 321. Eventually, on the BSE.

: The fintech unicorn has raised the debt in a round co-led by Neo Group and Trifecta Capital. This is part of a larger INR 400 Cr round that the company intends to raise in the near future.

: The payments bank plans to shift its focus to targeting mass-market consumers and introduce corporate digital payment tools to bolster its top line. The company is eyeing a 20-25% jump in revenues in the ongoing fiscal year as it looks to transition to an SFB.

: The travel-focussed SaaS company has appointed Rohan Mittal as its new CFO and also elevated Deepak Kapoor as CTO. This follows Mittal resigning from his position as the CFO of Yatra last month.

: The D2C brand has raised the funds in a Series B funding round led by Susquehanna Asia VC. The Mumbai-based startup sells gut health and wellness products that help individuals with poor dietary and lifestyle habits.

During a hearing on pleas filed by online gaming companies challenging retrospective GST demands totalling INR 1.12 Lakh Cr, the DGGI told the SC that these platforms are engaged in activities similar to betting and gambling, making them liable for 28% GST.

The Apple vendor aims to expand the production of AirPods enclosures in the country by tapping into its planned second facility in Tamil Nadu’s Tiruchirappalli. This follows Jabil executives meeting Tamil Nadu CM MK Stalin last month.

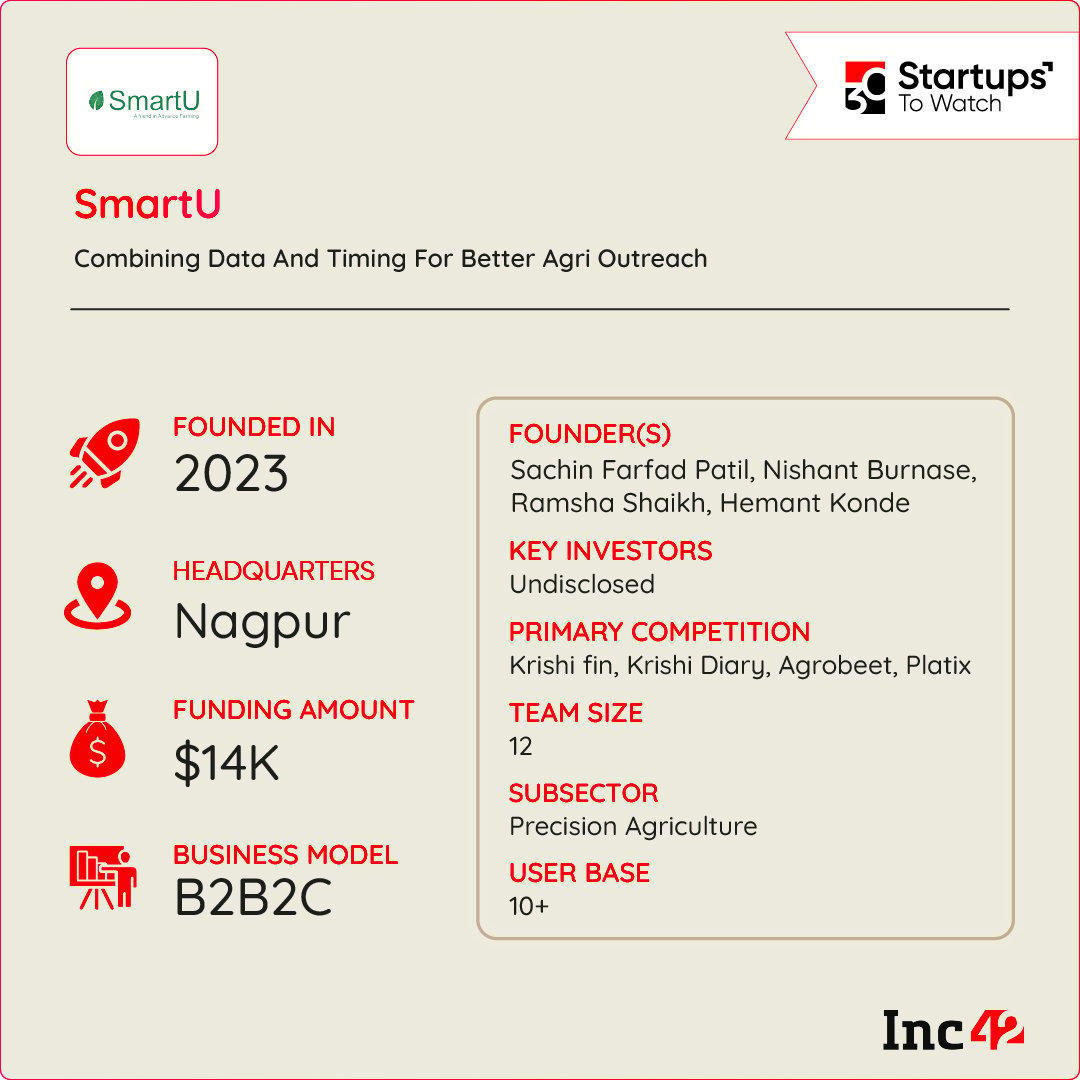

Inc42 Startup Spotlight How SmartU Is Making Farming More IntelligentThe Indian agriculture sector is one of the biggest contributors to the country’s GDP. Despite its massive size, Indian farmers continue to rely on outdated farming methods. This not only impacts farm yields but also farmers’ income.

Growing up in farming families, Sachin Farfad Patil, Nishant Burnase, and Hemant Kond launched SmartU in 2024 to tackle these challenges head-on.

Empowering Farmers With Tech: The agritech startup’s flagship offering, SmartU D2F, is a data platform that enables hyper-local, personalised agri marketing with granular farmer insights (crop type, land size, harvesting stages) with pincode-level precision.

Driving Value Across the Chain: The platform delivers custom communication to farmers via WhatsApp, IVRS, SMS, RCS, and mobile apps on key events such as rain, sowing, and harvesting, ensuring maximum impact and engagement. On the other hand, it also connects retailers directly with farmers, helping the former track their supply chain and buy inputs at affordable prices.

With India’s agritech market projected to touch $580.82 Bn by 2028, SmartU faces the challenge of carving out a distinct position in an increasingly crowded landscape. The question is:

The post appeared first on .

You may also like

Cardiff High School on lockdown after 'altercation' outside gates

'Retro' director Karthik Subbaraj spills the reason behind casting Pooja Hegde

World Snooker Championship obliterates BBC record as fans lap up drama

Rohit Sharma Announces Retirement from Test Cricket: A Journey of Perseverance

IAS officer Pradeep Dahiya takes charge as Gurugram's Municipal Commissioner