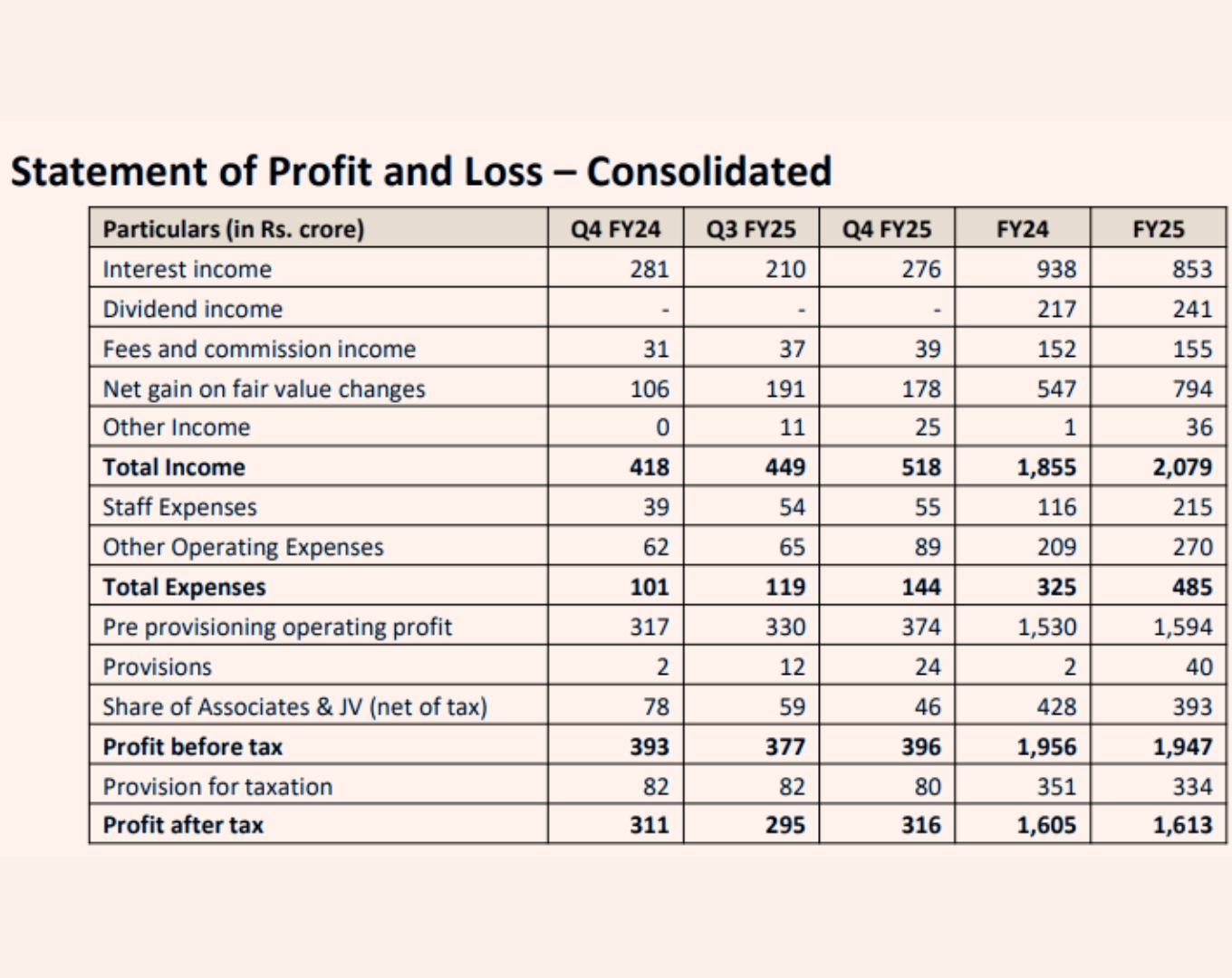

Fintech company Jio Financial Services (JFS) posted a consolidated net profit of INR 316.11 Cr in the fourth quarter of the financial year 2024-25 (Q4 FY25), a marginal 1.7% increase from INR 310.63 Cr in the year-ago quarter.

Sequentially, net profit increased 7.2% from INR 294.78 Cr.

JFS’ revenue from operations rose 17.9% to INR 493.24 Cr during the quarter under review from INR 418.10 Cr in Q4 FY24. On a quarter-on-quarter (QoQ) basis, operating revenue grew 12.5% from INR 438.35 Cr.

Including other income of INR 25.12 Cr, the fintech company’s total revenue for Q4 FY25 stood at INR 518.36 Cr.

Total expenses shot up 63.5% to INR 168.66 Cr in Q4 FY25 from INR 103.12 Cr in the year-ago quarter. On a QoQ basis, expenses increased 15.5% from INR 146.07 Cr.

For the entire fiscal year FY25, JFS’ PAT remained almost flat at INR 1,612.59 Cr, a slight 0.5% increase from the INR 1,604.55 Cr.

The company reported a 10.2% YoY jump in its operating revenue to INR 2,042.91 Cr in FY25.

The fintech company, which was spun off from Reliance Industries via a demerger in July 2023, has four verticals lending (Jio Finance Ltd or JFL), payments solutions (Jio Payment Solutions Ltd), insurance (Jio Insurance Broking Ltd) and payments bank (Jio Payments Bank Ltd). All of these offerings are housed under its app — JioFinance.

The company claimed that the app recorded a monthly active user base of 8 Mn at the end of March 2025.

“In FY26, we will build upon this momentum by leveraging our integrated data infrastructure and AI-driven analytics to offer the right product to the right customer, through the right channel,” Jio Finance CEO and MD Hitesh Sethia said.

Here’s a snapshot of the financial performance of the company in Q4 and the entire FY25.

Jio Finance LtdThe lending arm of the company took the spotlight in JFS’ investor presentation. At the end of FY25, JFL’s assets under management (AUM) stood at INR 10,053 Cr, a jump of about 140% from INR 4,199 at the end of the December quarter.

A key focal point for JFL’s expansion has been the growth of its physical presence, for which the company says it is leveraging its group ecosystem distributors to further its retail lending products.

Besides, the company also said that it has increased its partnerships with wealth management companies and banks and entered into marketing tie-ups.

JFS said that JFL expanded its presence to 10 tier-I cities at the end of FY25, on the back of a strong demand for its suite of retail and corporate lending solutions.

To expand the NBFC’s arms capacity, last month to “finance its business operations”.

JFL offers home loan, loan against property, loan against mutual funds and loan against shares. It is focussing on HNIs/UHNIs, affluent and mass affluent segments for these offerings.

Earlier this month, the NBFC arm by introducing loans against securities. The new offering will allow customers to avail loans of up to INR 1 Cr with interest rates starting at 9.99%.

Jio Payments Bank LtdThe banking arm of JFS saw growth across its key metrics. While CASA (Current Account Savings Account) for JFS jumped 3X YoY to 2.31 Mn, cash deposits zoomed 235% to INR 295 Cr.

Besides, Jio Payments Bank expanded its network of business correspondents (BC) to 14,000+, an over six-fold increase over FY24, the company claimed.

The bank’s product portfolio includes CASA variants, including sweep and salary accounts, physical and virtual debit cards, wallets, domestic money transfer and Aadhaar-enabled payment systems.

In March, JFS announced that it will be in Jio Payments Bank. The company acquired the stake from SBI for INR 104.54 Cr.

On the UPI front, JFS continues to trail other leading players at the end of March.

Jio Payment Solutions LtdProcessing 4.08 Mn transactions worth INR 318.20 Cr in the month of March, Jio Payments Bank was the 30th most used UPI app.

The company didn’t disclose much about this vertical, and only said that it will be focussing on profitable growth and expanding contribution margin in the future.

Jio Payment Solutions is a payment aggregator and gateway provider that facilitates digital transactions for businesses and individuals.

It allows businesses to accept various payment methods, including UPI, credit cards, debit cards, and e-wallets, through online and offline channels.

Jio Insurance Broking LtdDuring the quarter under review, Jio Insurance Broking expanded its supply chain to 34 insurance partners and 61 direct-to-customer plans.

These include announcing plans across life, motor and health insurance verticals.

As of now, Jio Insurance Broking offers auto, two-wheeler, health and life (term and non-term) insurance plans. It also has embedded insurance products like solar panel insurance, cyber protection, credit life, property insurance and health insurance.

As per reports, JFS is following the end of the latter’s partnership with Bajaj Finserv.

BlackRock JVsBesides the existing verticals, JFS plans to enter three new verticals – asset management company (AMC), wealth management, and broking.

To foray into these verticals, the company has signed multiple joint venture (JV) agreements with BlackRock since 2023.

For the asset management business, the company has filed applications for final approvals and said that it has completed the development of a unified investment platform and infra deployment. As of now, it said that it is ready to launch with a defined product roadmap and go-to-market strategy.

While signing the JV agreement to enter the AMC business in July 2023, JFS and BlackRock set aside an initial investment of $150 Mn to acquire 50% stake each in the JV. In January 2025, both the parties cumulatively

On the wealth management front, the JV incorporated Jio BlackRock Investment Advisers Pvt Ltd in September 2024. It filed for the registered investment advisor licence in March 2025.

Setting its broking plans in motion, the JV set up Jio BlackRock Broking Pvt Ltd in January 2025 and consequently filed its application for a broking licence in March.

The companies inked in April 2024.

Shares of JFS ended Thursday’s trading session 1.73% higher from the previous close at INR 246.45 on the BSE.

The post appeared first on .

You may also like

Hindi in Maharashtra after NEP: Why BJP is walking on a tightrope?

Harvard–Trump row over antisemitism letter may have stemmed from a mistake: Report

Former underworld don Muthappa Rai's son shot at in K'taka

Delhi court extends judicial custody of Naresh Balyan, others for 4 days

21-year-old Indian student killed by stray bullet in Canada