When was the last time you flaunted a Dior or a (Yves) Saint Laurent outfit at a happening do and wowed all with its exquisite charm? Much of the sartorial magic created by global fashion brands is the handiwork of Indian karigars, as most of us are aware by now. The lives of those who make our clothes are not pretty, to say the least. It is a fragmented market where payouts are abysmally low, and working conditions are far from satisfactory.

Until now, fashion manufacturing in India was equally unattractive. It used to run like a clunky machine, rigid and outdated. Factories were built for bulk, not quick pivots. Long lead times and massive MOQs (minimum order quantities) were the usual norms. And tech innovation in this space was barely a blip. The entire ecosystem was a slow-moving maze — opaque, outdated and not prone to change.

Then, the world shifted. Post-Covid, everything from how people shop to what they want to buy has changed — and fast. Consumers today are a digital-first lot who are not just online; they are always on. They look for the latest trends and fresh styles, and they want it now. That pressure has lit a fire under the industry, and brands of all sizes are now replacing the old-school mass production model with nimble, tech-first systems that can turn on a dime. Fast fashion is no longer a trend; it is a demand.

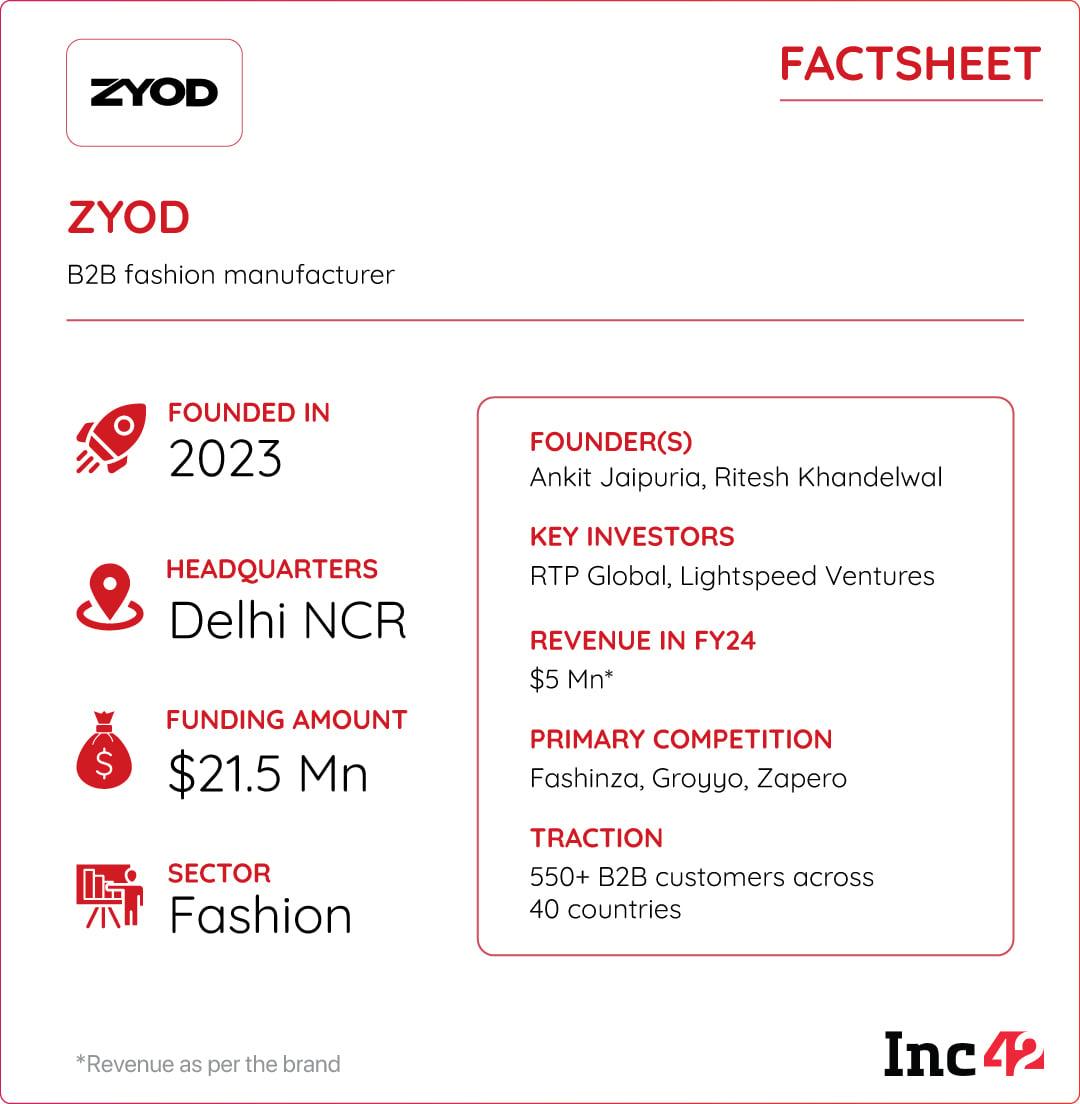

ZYOD Has Dared To Dream, But Is It Rising From Zero To One?For serial entrepreneur Ankit Jaipuria, a mechanical engineer from IIT Delhi, these shifts in consumer mindset and manufacturing timelines unveiled an opportunity. He joined forces with Ritesh Khandelwal, an alumnus of IIM Kashipur and founder of several startups, to establish ZYOD in January 2023.

The B2B fashion manufacturing platform provides design-to-delivery solutions to local and global fashion brands, as well as direct-to-consumer (D2C) fashion businesses. It sources fabrics from reliable suppliers across the country and runs a marketplace, connecting local and global fashion brands with vetted Indian factories for fast and smooth production cycles. It has recently partnered with FAN MANIA, one of the largest consumer product licensees in the apparel and accessories space, to expand its presence in the licensed merchandise market.

Although it is one the youngest players specialising in fashion manufacturing as a service, ZYOD is growing at a fast clip. After two years of its launch, the platform is operating in 40 countries and catering to more than 500 SMEs, 550+ D2C companies and 50+ global brands and fashion conglomerates such as the Landmark Group, Reliance Retail, NEXT, Walmart, Gymshark and more. Its key competitors include a host of new-age funded startups such as Fashinza, Groyyo, Zapero, Bijnis and Thimblerr.

ZYOD collaborates with 50 tech professionals and designers to develop a catalogue of 10K+ unique styles per month. With lower MOQ thresholds for agility, the entire design-to-delivery process has been compressed into a 50-day cycle. At the centre of this ecosystem is a proprietary ERP programme for real-time visibility across operations, along with a host of technology solutions, including AI-driven forecasts of fashion trends, efficient line planning, streamlined manufacturing, and quality enhancement. It has also established three tech-powered excellence hubs in Gurugram (Delhi NCR) and Jaipur (Rajasthan) for technology integration, speed and sustainability (more on this later).

The outcome: Brands can design and release their collections quickly and efficiently, with far less risk of unsold inventory.

“You require manufacturing that evolves in real time,” said Jaipuria, emphasising the need for agility, data intelligence and sustainability. A traditional production cycle, ranging from 120-180 days, often leaves brands with designs that feel dated even before they hit the racks. In contrast, ZYOD can lower the MOQ as per requirement, a move that unlocks manufacturing for small brands without high upfront costs or excess inventory.

That ZYOD has developed an innovative, right-sized and demand-driven workflow through process standardisation and quality integration is crucial not only for a fast-growing fashion industry but also for investors, as brands are often forced to write off huge unsold inventories due to product obsolescence. According to a report by The Guardian, around 10-40% of the 80-150 Bn garments globally produced every year are never sold. ZYOD aims to shrink that gap by giving brands the ability to test styles quickly, pivot production mid-cycle and maintain tighter control over what enters the supply chain.

But the question is: Can a fledgling brand, buoyed by just two years of financial operations, be catapulted from zero to one due to its low MOQ and tech-powered sustainable manufacturing?

A dive into ZYOD’s capital inflows and revenue trajectory may offer early clues to its growing momentum in the fast-fashion supply chain. Since its launch, ZYOD has raised a total of $21.5 Mn across three rounds. The most recent infusion came in 2024 whenit secured $18 Mn through a mix of equity and debt. The round was led by RTP Global, a VC firm backing technology-first, high-growth companies. An earlier round saw Lightspeed Venture Partners anchor a $3.5 Mn investment.

Jaipuria also claimed that the platform clocked $20 Mn (INR 171.2 Cr, unaudited results) in FY25, a fourfold increase from the $5 Mn (INR 42.8 Cr) reported in the previous fiscal year.

While some industry veterans may argue that it’s premature to read too deeply into these numbers, one thing is indisputable. Investors are paying attention. What’s turning heads isn’t just the topline growth — which continues to climb steadily, even amid rapid scaling — but the startup’s use of technology to streamline and optimise every facet of the production chain.

For Jaipuria, the ambition was never about taking ZYOD from zero to one. It was about reimagining the entire fashion manufacturing ecosystem and pushing a legacy industry into the future. The inspiration? His formative stint at Fashinza, where the seeds of transformation were first sown.

Why Fashion Manufacturing Needed A Deep Reset To Generate Long-Term ValueBorn into a family entrenched in the textile trade, Jaipuria had seen the ins and outs of wholesale and retail markets. But the world of yarns and yards never attracted him, as it presented a chaotic, outdated system. “There was no [process] standardisation and no tech. It felt more like firefighting than building,” he told Inc42.

His career charted a different course, spanning oil & gas, maritime logistics and retail. Those businesses took him across India and the Middle East. But fashion manufacturing, in those years, was not even a flicker on the horizon.

Then came Covid-19, and the seismic changes it brought disrupted many industries, including fashion. But it was only after joining Fashinza in February 2021 that he gained a ringside view of fashion brands’ changing requirements and the limitations of existing supply models. Incidentally, Khandelwal, ZYOD’s other cofounder, was also part of that startup’s founding team for three years.

“Before Covid, shoppers went to stores maybe once a month. During the pandemic, it became a constant obsession, with smartphones serving as the new storefronts and style discovery turning into an endless scroll. Brands faced mounting pressure to deliver more styles at a faster rate,” said Jaipuria.

Meanwhile, bulk production and rising MOQs were another critical issue, offering zero flexibility for smaller batches. “Most manufacturers had set it at 2K pieces per style, making it nearly impossible for brands to experiment with trends or quickly respond to new ones,” observed Jaipuria. “Even big fashion houses like H&M, fabindia, Biba, W, Pantaloons and Max Fashion barely managed to cut lead times to 90-120 days. But it wasn’t fast enough.”

Although agility is the watchword here, it comes at a cost. Constant shifts in design and demand frequently result in operational lags. Processes tailored for fleeting trends choke production lines. Mercurial consumer tastes make overstock not just a risk but a recurring liability. Additionally, excess inventory ties up working capital and hinders the ability to scale successful products quickly.

By delving into this ‘market of contradictions’, Jaipuria soon realised that fashion needed more than a facelift. It required an entirely new production engine built on supply chain standardisation — robust workflows, reliable timelines and the consistent quality of deliverables. Once these criteria are firmly in place, trust becomes a valuable currency, especially in the B2B space, where growth is often tied to average order values.

ZYOD’s USP has been built on these principles. The startup brings discipline to the chaos of fashion production by engineering uniform workflows across design, quality control and logistics. Beyond execution, it partners with clients to forecast demand and stabilise order planning, turning uncertainty into a competitive advantage.

Here is a hypothetical case. Based on the current market demand for 10K tees of a special style, the platform can back-calculate how many machines will be needed to fulfil the order. This model enables dynamic allocations, ensuring that production scales seamlessly with order sizes, from boutique batches to bulk consignments. The outcome: Future-aligned planning, maximum efficiency and minimum bottlenecks to reduce the classic volatility of fast fashion.

Four Takeaways From Fashinza That Shaped The ZYOD BlueprintBefore launching ZYOD, Jaipuria did his homework well and spent a whole year at Fashinza’s founder’s office, working closely with global brands and suppliers to identify major challenges. At the time, it was an emerging player connecting brands with manufacturers through technology, claiming to digitalise the supply chain, reduce lead times and improve transparency.

Fashinza burst onto the scene with the swagger of a breakout star, raising $75 Mn from marquee investors such as Accel, Prosus, WestBridge and Elevation Capital within two years of its launch. But the early momentum proved difficult to sustain. In the 18 months that followed, its gross merchandise value (GMV) reportedly slid to $40 Mn and has since plateaued. Behind the scenes, the cracks began to show. A wave of senior executive departures and sweeping layoffs signalled deeper operational strains.

But first things first. From his vantage point, Jaipuria watched as Fashinza scaled quickly — fast enough to affirm a deeper insight. The fundamental transformation in fashion wasn’t happening on the runway or even in retail. It was unfolding behind the scenes, in the infrastructure, where the industry still relied on slow, opaque systems.

“At Fashinza, I realised brands weren’t just chasing lower costs,” he said. “They were desperate for faster design cycles, smaller production runs and real-time visibility. The existing system wasn’t built for that.”

Many startups, he noted, were attempting to solve these problems with platform models — marketplaces that facilitated supplier discovery. But the deeper Jaipuria explored, the more evident it became that the challenge was not about matchmaking. The actual bottleneck lay in production capability, quality control and operational consistency on the supply side. This understanding finally prompted him to launch ZYOD, not as a service platform but as a comprehensive solution provider for modern fashion manufacturing.

Here are the four takeaways from Fashinza that helped the founder develop ZYOD’s blueprint:

- The real problem was not just finding suppliers. There weren’t enough reliable suppliers available.

- Some large manufacturers were very rigid about their high minimum orders. Smaller ones were flexible but lacked the processes and technologies to cater to big brands.

- The coordination between brands and manufacturers was hands-on rather than process-driven. The existing system lacked the control and standardisation required for on-time delivery and high quality.

- Enablers must move beyond connecting brands with suppliers and start building and managing new-age manufacturing solutions.

Today, the fundamental difference between the two startups lies in their approaches to manufacturing and control. For instance, ZYOD runs a hub-and-spoke model, with its company-owned, company-operated (COCO) hubs in Gurugram and Jaipur acting as centralised innovation and control centres.

Outfitted with IoT-enabled tools, automated quality checks and real-time data analytics, these hubs oversee a network of spokes across the manufacturing clusters of northern India, including Noida, Ghaziabad, Gurugram and Jaipur.

Its early strategy hinged on partnering with small to mid-sized manufacturers, embedding a four-pillar operational team — a designer, a pattern master, a merchandiser and a quality lead — within each unit. However, this hyperlocal, high-touch model did more than capacity building. It was also about cultural re-engineering, creating a supply chain that is conditioned for accountability, process adherence and scalability. ZYOD’s deep tech integration, from product development to real-time production tracking, enhances its control over quality and delivery.

Fashinza, by contrast, operates as a tech-enabled sourcing marketplace, connecting brands to a global pool of third-party manufacturers. However, it stops short of operational standardisation or owning/managing production processes, as control is ceded in favour of flexibility.

Inside ZYOD’s Tech-Powered Excellence HubsZYOD has set up three state-of-the-art excellence hubs in Gurugram and Jaipur, strategic locations that complement India’s textile artistry with precision technology. With these capabilities in place, it can easily scale operations without sacrificing quality or speed, two cornerstones often at odds in traditional manufacturing. Better still, both locations benefit from well-established logistics corridors, critical for a fast-moving supply chain designed to deliver at retail velocity.

Embedded within key factory networks, these innovation centres are fully equipped with advanced tools to transform the way garments are designed, produced and delivered. For instance, ZYOD’s proprietary ERP system tracks everything — from the number of pieces being manufactured to the status of each order on the shop floor. This real-time data visibility at every step ensures fast decision-making and quick implementation.

Again, the platform’s predictive analytics, digital sampling, AI-driven line planning and automated quality control reduce rework and waste. When a brand places an order, it can log in to ZYOD’s tech platform to upload design briefs or select styles from the catalogue. The startup’s AI tools assist the brand by forecasting trends and recommending silhouettes tailored to its preference. When the design is finalised, the order moves to an innovation hub, where full-scale samples are created using IoT-enabled cutting and stitching machines and automated quality checks. After sample approval, bulk production is carried out in partner factories. Throughout the manufacturing cycle, ZYOD’s integrated ERP system tracks progress in real time.

To speed up turnaround time, it breaks down fashion elements into modular parts. Think of cuts, colours, silhouettes and fabrics turned into algorithms to assess what will resonate best. Next time, brands can tweak a few details here and there to achieve a unique look and feel rather than creating the entire concept from scratch. This flexibility also allows companies to group their orders based on specific elements, such as fabrics or prints.

Over time, ZYOD has become more attuned to its clients’ requirements. Behind the scenes, a learning model quietly tracks client preferences. Suppose a brand picks 20 designs but rejects 80. As soon as that happens, the system starts connecting the dots, learning what appeals to them. Perhaps it’s a silhouette, or maybe a colour, or that one fabric or print that keeps popping up.

“Eventually, the system can suggest something as specific as a navy linen dress with cut sleeves and animal print,” said Jaipuria. “It’s like having a digital stylist who remembers every choice you have made and then gets better with each one.”

This model powers the platform’s design recommendation engine, helping brands discover and customise styles faster.

Currently, ZYOD uses both predictive and GenAI for several purposes. While predictive models forecast production risks, such as delays or quality lapses, to improve planning and execution, the use of GenAI (generative AI) tools pushes creative boundaries. Instead of expensive photo shoots, it can create realistic mockups in the early stages for rapid prototyping and faster, leaner, more collaborative design iterations.

Can ZYOD Usher In Fashion Factories Of The Future?The fashion industry in India is at an inflexion point. Long celebrated for its rich textile traditions and cost-effective resources, the country is now confronting a hard truth: it has fallen behind. While China, Vietnam, and even Bangladesh have aggressively adopted automation and agile supply systems, many Indian companies still rely on outdated infrastructure.

And yet, the opportunity is massive. Overall, India’s textile and apparel market size is growing at a CAGR of 14.6% from $172.3 Bn in 2022 and is projected to reach $387.3 Bn by 2028. Apparel exports rose to $1.6 Bn in January 2025, up from $1.4 Bn a year earlier. However, with the government now targeting a $1.8 Tn domestic textile economy and $100 Bn in exports by 2030, incremental gains will no longer suffice.

To meet these ambitious goals, fashion manufacturing and all related sectors must do more than scale — they must transform. Technology, traceability and elevated quality standards will no longer be optional. The path to global competitiveness will not be defined solely by volume but rather by a sweeping digital and structural reinvention.

This is the terrain ZYOD is trying to navigate. As an enabler helping fashion labels, its proposition is deceptively simple: Digitalise your shop floors, onboard a local and global client base, and produce varied SKUs without inflating overhead. But the biggest hurdle to getting it done won’t be technology. It will be trust.

“Convincing brands, manufacturers and even our team to adopt a different production model is most difficult,” said Jaipuria. “The prevailing belief was that fast fashion required high MOQs and long lead times.” To overcome this, ZYOD ran pilots that demonstrated its ability to deliver high-quality garments within 30 to 40 days.

Now, the startup aims to deepen its global footprint and expand into key international markets, including Japan, Australia, the UK, Spain and Portugal. Additionally, it will strengthen its manufacturing base in India and invest more in IoT automation and smart factory infrastructure.

At the heart of this strategy lies a bold vision to elevate India’s share of global apparel exports from around 3% to 5% within the next three to four years. By offering a fully integrated solution, ZYOD aims to become the go-to backend for global fashion brands, transforming legacy operations into a seamless, tech-enabled engine for growth.

But in doing so, challenges will multiply. Ensuring quality at higher volumes, integrating more factories into its system and navigating regulatory frameworks across borders will be anything but easy.

Still, the startup has embedded itself deeper into the production stack, functioning less as a service provider and more as the middleware between demand and delivery, data and design. What it is building is more than a supply chain solution. If successful, ZYOD could redefine the backend of modern fashion, quietly powering a new generation of brands that demand speed, flexibility and sustainability without compromise. In an industry ripe for reinvention, that may be the hardest — and most valuable — stitch of all.

[Edited By Sanghamitra Mandal]

The post How ZYOD Is Powering A New Wave Of On-Demand Fashion Manufacturing appeared first on Inc42 Media.

You may also like

Congress appoints DCC presidents in Gujarat under 'Sangathan Srijan Abhiyan'

Health Tips- Does applying turmeric really cure the injury, let's know the whole truth

Let's talk about...tourists, go home!

Royal Ascot full results: Tips and racecard as jockey blasted over 'terrible ride'

Is it safe to eat a handful of dried fruits and nuts with green tea as a snack?